Need for Crop Insurance in India

Agricultural Insurance culture is not new to India and various government schemes have been initiated in the last 3-4 decades. Ever since the introduction of the Comprehensive Crop Insurance Scheme (CCIS) in 1985 varied approaches have been applied over the years; The National Agricultural Insurance Scheme (NAIS) in 1999, followed by weather based crop insurance scheme (WBCIS) since 2007, and the Modified NAIS (mNAIS) since 2010. These insurance schemes successfully reached out to millions of farmers and covered 22 percent of the gross agricultural farmlands in the country by 2014.

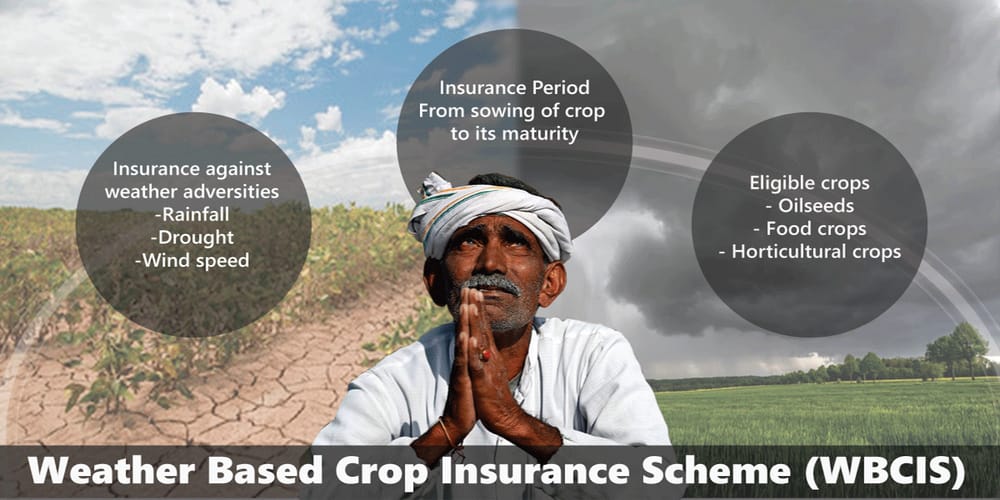

Indian subcontinent is divided into 128 Agro-climatic zones, each experiencing its own set of weather conditions. Some of the regions witness extreme conditions leading to huge losses to farmers at multiple stages of harvest. Weather Based crop insurance Scheme (WBCIS) was envisaged to mitigate the farmers against adverse weather conditions like heavy rainfall, dry spells, humidity, frost, temperature etc.

Risk period for this scheme ranges from sowing to maturity of crop. Unlike traditional National Agricultural Insurance Scheme (NAIS) which also covers risks beyond weather perils, WBCIS remains focussed on the losses due to unfavourable weather conditions only.This innovative product not only brought transparency in the system but also facilitated quicker claim settlement than yield based insurance schemes.

As of today, the weather index insurance market in India is the world’s largest, having transformed to a large-scale Weather based crop insurance scheme (WBCIS) covering over 9 million farmers. WBCIS was a milestone in insurance penetration due to the fact that it allowed private participation leading to a more competitive product. Also, the rate of subsidy was also better than traditional schemes.

Limitations of Weather Based Crop Insurance Scheme (WBCIS)

However, one design flaw in the weather index based insurance scheme was the basis risk. I.e. This scheme didn’t safeguard against any localised events like cloudburst, hailstorm, pest attacks or any event leading to genuinely lower yield. This flaw led to limited demand among the farmers. Companies are looking at a hybrid model wherein both weather indices and yield would be considered for the claims. This might delay the claim settlement process but insurance volume is bound to increase and inch us closer to the target of doubling farmer’s income by 2024.

Weather based crop insurance scheme (WBCIS) works on an Area Based Approach wherein ‘Reference Unit Area (RUA)’ is deemed to be a homogeneous unit of Insurance. Each RUA is linked to a Reference Weather Station (RWS), on the basis of which current weather data and the claims are processed. The parameters or indices are fixed for each RUA and claims are triggered by measurement of those indices.

Owing to the nature of the loss assessment process, which is predominantly driven by data, it is imperative to have a reliable technology that can measure the weather indices with accuracy and speed for efficient claims settlement. The Internet of Things (IOT) can be of great use to broadcast the real-time information on weather and soil conditions and help maintain a data repository to build predictive weather models. This would go beyond just loss assessment by helping design insurance packages tailored for each RUA. This measure can revolutionise the existing risk profiling process which is mostly manual and time consuming and prone to sampling and non-sampling errors and manual subjectivities.

Role that technology can play in streamlining farm insurance

The aim of weather index based insurance schemes should be to minimize basis risk. One way to achieve it is to establish more weather stations infrastructure by public and private entities to bridge the gap arising due to distance between farmland and the weather station.The Reference Weather Station (RWS) can be empowered with drones, satellite imaging, and soil sensing technology to save the huge cost and manpower that goes into visiting and monitoring the farms by the officials.

With rising smartphone penetration and internet connectivity in rural India, it’s very much required to develop relevant mobile applications for the farmers where they can access the information related to their insurance schemes and track the settlement process conveniently. This app based approach can also act as a digital marketplace for the farmers to choose the insurance package that suits their requirements.

There are multiple challenges in the agri-insurance space that inflate operational costs like data collection, processing and management, premium payment mechanisms as well as claims verification and settlement. Index insurance products, mobile payment devices or more accurate weather and agricultural-yield information based on satellite data are examples of technological solutions that can solve these issues to a large extent.

Focus Agritech’s Outlook:

Government of India is looking forward to an investment value of $100m for technology intervention in its agriculture insurance programme to make the system more robust and attractive for the farmers. This is an encouraging announcement for the tech companies to enter the field with cutting edge technology like drones, soil sensors, and other IOT based devices to utilise data based approach for better results.

The Restructure Weather Based Crop Insurance Scheme (RWBCIS) launched in 2016 calls for establishing more Automated Weather Stations (AWS) which signals potential PPP and opportunity for manufacturers to come up with the most technologically equipped version to outbid the competitors. The budget allocation of Rs10,000 crore to the BharatNet Project and the set target of covering 150,000 gram panchayats with high-speed Internet will further provide the requisite ecosystem for digital revolution in rural India.

Companies to Watch: Davis Instruments, AcuRite, Raven Industries, Skymet, IFFCO-Tokio General Insurance Company (ITGI), ICICI Lombard, Agriculture Insurance Company (AIC)

Recent Article

India’s next AADHAR exercise to cover its entire livestock population